Sacs Software Limited - MTD for SAGE 50

SAGE 50 VERSION 24 OR BELLOW CAN FILE VAT RETURN

SACS-MTD is fully compliant with Making Tax Digital

01

User-Friendly Interface

Enjoy a streamlined experience that enables quick setup and easy navigation for you and your staff.

02

Secure Payment Processing

Accept various payment methods with confidence, ensuring your customers' data is always protected.

03

Comprehensive Reporting

Gain insights into sales trends, customer behavior, and operational performance to drive informed business decisions.

MTD for SAGE 50

Sage is fully Compliant with Making Tax Digital

If you currently use Sage 50, you may have been contacted by them telling you that your version of Sage 50 will not file VAT returns for Making Tax Digital and you have the following options:

- Pay for an MTD bolt on to file the VAT return.

- Pay for the new Sage 50c.

What they haven’t said is that your current version of Sage is fully compliant with Making Tax Digital, except for the fact that you cannot submit the VAT return from the software.

However, there is a simple solution to all this which does not require upgrade costs. Instead you can carry on using your current version of Sage 50 and when it is time to submit the VAT return:

1. Download the SACS MTD link to Sage50

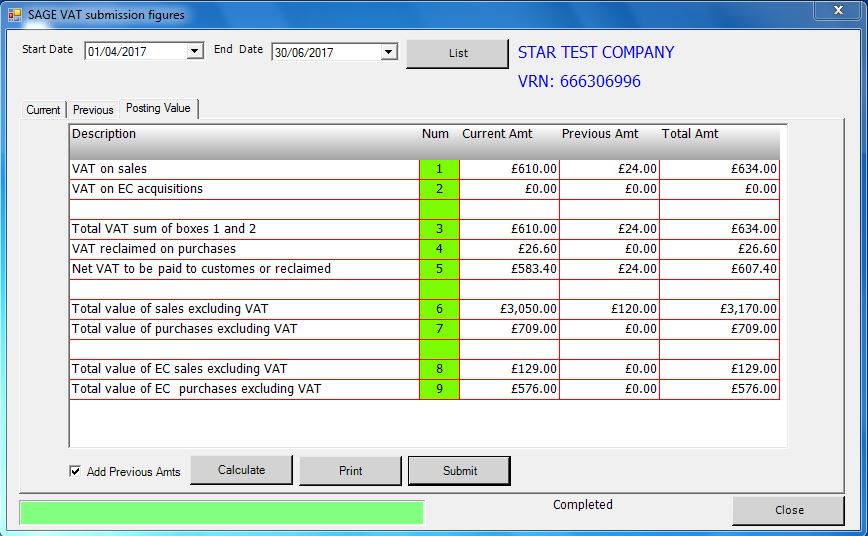

2. You can use your Sage 50 as normal to prepare VAT Return

3. Then file the VAT return direct to HMRC using SACS MTD

The cost is £100 pa for the first VAT license, £25 pa each for the next 9 licenses and £10 pa each thereafter. All the above prices are subject to VAT at the standard rate.