SACS MTD

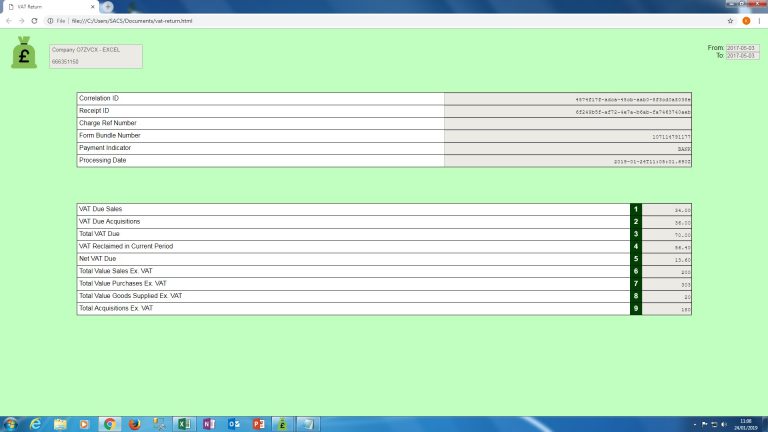

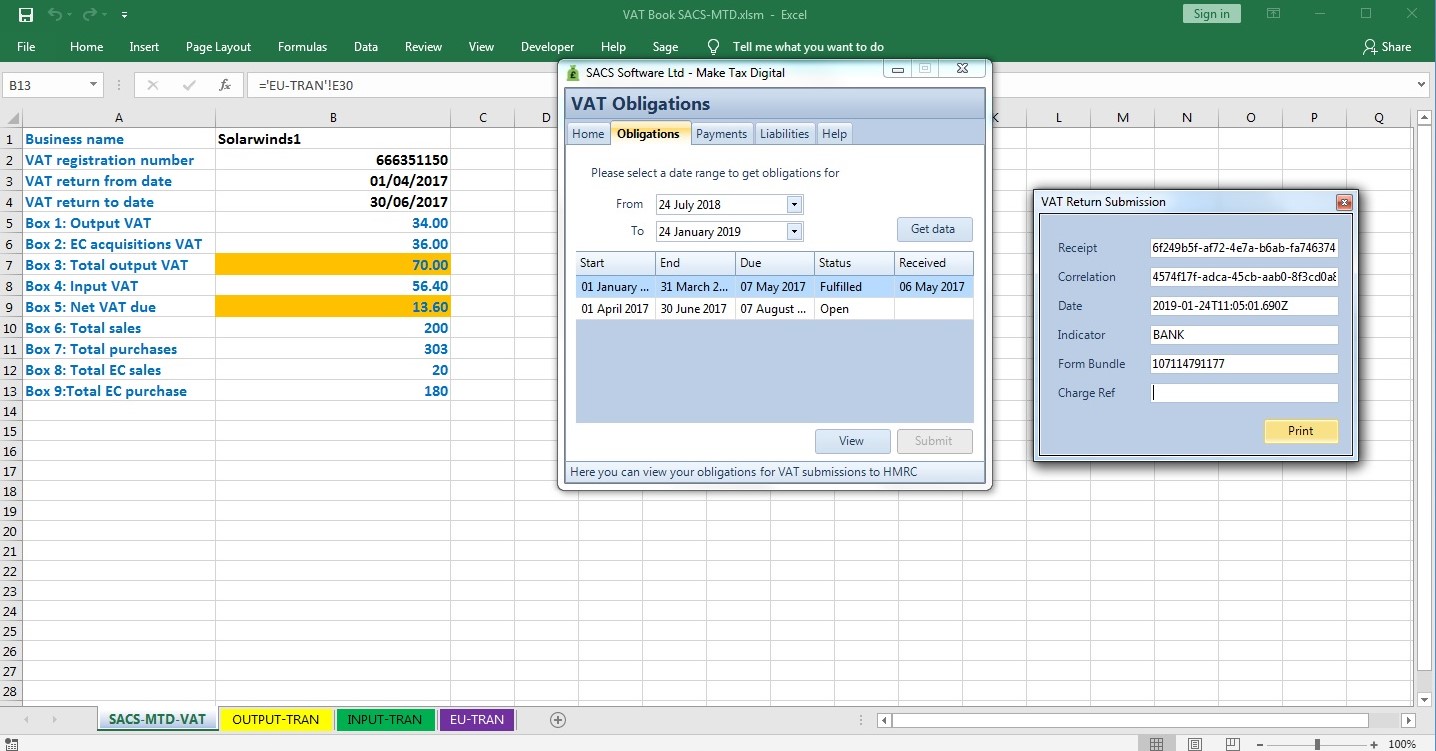

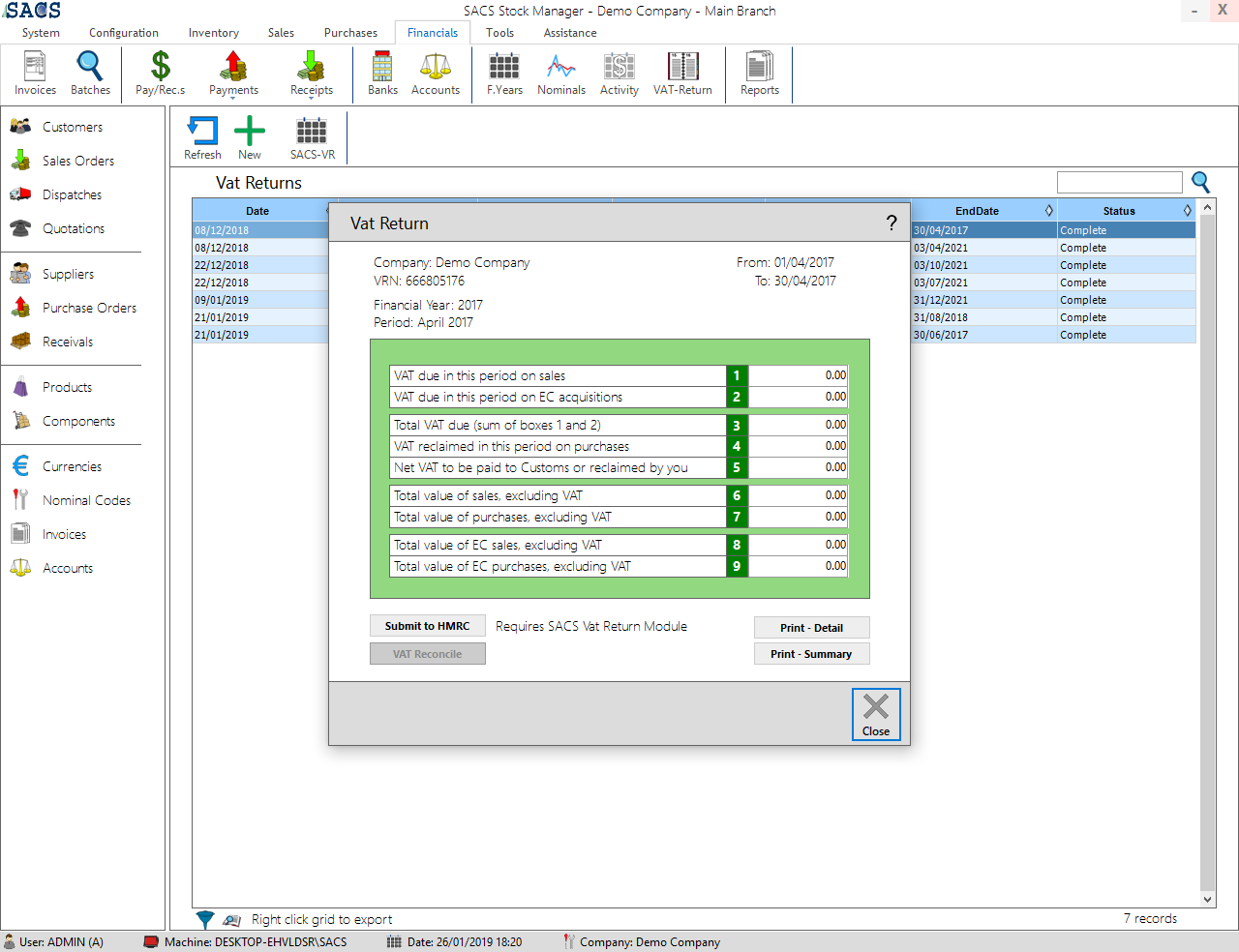

Utility to be used to file VAT Return to HMRC, on Excel or on Accounts Software that has no MTD facility. It collects the VAT Return figures from your Excel or Accounts system and submits them to HMRC via MTD. It then retains a log of HMRC responses and proof of receipt.